尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

Should fossil fuel and industrial companies spend billions trying to build new, “cleaner” businesses? Or simply squeeze as much cash as possible from existing operations, even if they are in structural decline? This is one of the defining questions of the decade in many sectors.

化石燃料和工业公司是否应该投入数十亿美元尝试建立新的、更“清洁”的业务?还是应该尽可能从现有业务中榨取现金,即使这些业务正处于结构性衰退中?这是本十年许多行业面临的关键问题之一。

Successful case studies backing up option A are becoming fewer and farther between. The 207-year-old British industrial group Johnson Matthey’s latest transformation shows how well-meaning ideas can turn into expensive misfires — as well as the dangers of becoming a “jam tomorrow” energy transition stock.

支持选项A的成功案例越来越稀少。拥有207年历史的英国工业集团庄信万丰(Johnson Matthey)的最新转型显示出,尽管初衷良好,但这些想法可能会变成代价高昂的失误——而且公司有风险成为“明日果酱”(jam tomorrow, 比喻实现不了的许诺——译者注)能源转型股票。

Standard Investments, Johnson Matthey’s largest shareholder, on Monday attacked the group for spending “significant capital” on “unproven” growth businesses. It is not hard to see why the group is coming under pressure: it trades about a fifth lower than rivals on a forward EV/ebitda basis on FactSet data.

庄信万丰的最大股东Standard Investments周一批评该集团在“未经验证”的增长业务上花费了“大量资本”。不难看出该集团为何面临压力:根据FactSet的数据,其企业价值倍数(EV/ebitda)比竞争对手低五分之一左右。

Johnson Matthey is known for its catalytic converter business, which is still highly cash generative, despite pressures on the auto sector. Indeed, the company has said the division will generate at least £4.5bn of cash in the decade to 2031, £2bn of which has already been delivered.

庄信万丰以其催化转化器业务而闻名,尽管汽车行业面临压力,该业务仍然具有很高的现金生成能力。事实上,公司表示,到2031年,该部门将至少产生45亿英镑的现金,其中20亿英镑已经实现。

Trouble is, catalytic converters should — over time — become obsolete as consumers switch from combustion engines. Liam Condon, who took over as chief executive in 2022, has hence pursued a strategy which relies, in part, on a bet that other technologies, such as “clean” hydrogen, will take off.

问题在于,随着消费者逐渐抛弃内燃机汽车,催化转化器应该会逐渐过时。利亚姆•康登(Liam Condon)于2022年接任首席执行官,因此他采取了一种战略,部分依赖于押注其他技术(如“清洁”氢能)将会兴起。

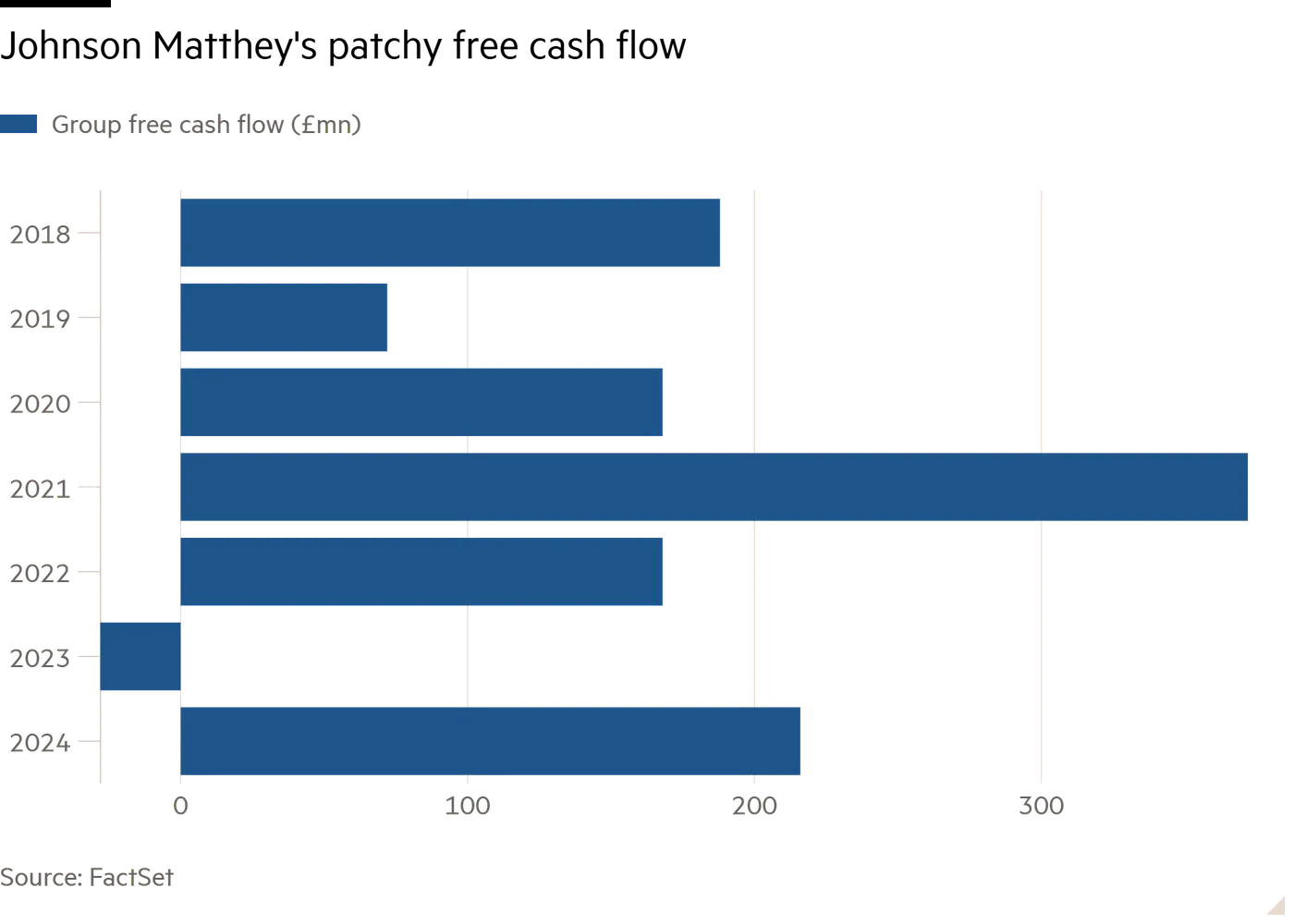

This involves substantial upfront investment. Excluding disposals, Johnson Matthey’s underlying business has since April 1 2021 burnt £135mn of cash, on Standard’s estimates. Growth businesses aren’t solely to blame: Johnson Matthey is also investing in its traditional businesses, including building a more efficient refinery in China for critical materials including platinum.

这涉及到大量的前期投资。根据Standard Investments的估算,自2021年4月1日以来,除去资产处置,庄信万丰的基础业务已经消耗了1.35亿英镑的现金。增长型业务并不是唯一的原因:庄信万丰还在其传统业务上进行投资,包括在中国建设一个更高效的精炼厂,用于处理包括铂在内的重要材料。

The hydrogen division — which makes components for fuel cells and electrolysers — has consumed £310mn of cash since the 2022 fiscal year, says Standard. That’s a concern given the clean hydrogen industry is faltering.

Standard Investments表示,自2022财年以来,生产燃料电池和电解槽组件的氢能部门已经消耗了3.1亿英镑的现金。考虑到清洁氢能行业正在衰退,这令人担忧。

Johnson Matthey may be hoping that shareholders will be willing to wait and see. Already, it has taken steps to stabilise the ship. It has delayed the start of production at a UK hydrogen components factory. Overall group capex, which totalled £1.1bn in the past three years, should reduce to £900mn over the next three. Cash flow generation should stabilise, reckons Panmure Liberum’s Lacie Midgley.

庄信万丰可能希望股东愿意耐心等待。公司已经采取措施来稳定局势。它推迟了英国一家氢能组件工厂的生产启动。过去三年,公司总资本支出为11亿英镑,预计在未来三年将减少到9亿英镑。Panmure Liberum的莱西•米奇利(Lacie Midgley)认为,现金流的产生应该会稳定下来。

The problem is shareholders have already been burnt by Johnson Matthey’s expensive foray into cathodes for electric vehicle batteries under previous management, which resulted in a £363mn impairment and restructuring charge.

问题在于,庄信万丰在前任管理层的主管下对电动车电池阴极的昂贵尝试,已经让股东们受到损失,这导致了3.63亿英镑的减值和重组费用。

As others such as BP know only too well, patience is wearing thin with “cash tomorrow” energy transition promises — no matter how visionary the strategy.

正如英国石油(BP)等公司的惨痛教训,人们对“明日现金”式的能源转型承诺已经失去耐心——无论战略多么具有前瞻性。